Understanding Your Retirement

Membership, Tier, and Retirement Eligibility

Knowing more about your membership, tier status, and retirement eligibility can help you better prepare for your retirement. Learn more by reviewing this section.

Retirement Will Change Your Life

Retirement is a significant life change and you won’t know how it will affect you until you retire. Whether you are thinking about retiring in two months, two years, or twenty years, we suggest watching this brief video to learn more about mentally preparing for retirement and what you may expect during these years.

Health Benefits

Retired members may be eligible to receive a monthly medical and dental plan subsidy to cover some or all their health care premium. A subsidy is a monthly dollar credit applied to the cost of your medical plan premium. The premium is the monthly cost of insurance coverage for a LACERS retired member and any dependents. Your subsidy may or may not cover the total cost of your monthly premium. If your subsidy is less than your monthly premium, the balance is deducted from your retirement allowance.

Summary Plan Description

This Summary Plan Description (SPD) is a general description of the main features of the benefits provided by the Los Angeles City Employees’ Retirement System (the Plan), as set forth in the Los Angeles City Charter and the Los Angeles Administrative Code. In the event of any discrepancies between the SPD and the provisions of the Plan, the Plan provisions will always govern.

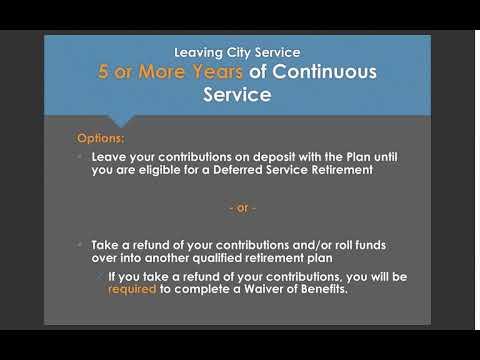

Leaving City Service Prior to Retiring

If you are not eligible for a Service Retirement, but are thinking of terminating City Service, you may still be eligible for certain benefits from LACERS. Your eligibility for these benefits will depend on the amount of Continuous Service you have when you leave City Service.

If you have less than five years of Continuous Service, you can either:

Designating Beneficiaries – Active Members

As a member, you may designate a beneficiary who will be entitled to receive certain benefits that may be payable upon your death. You can designate any person or legal entity (such as a living trust) as a beneficiary and you may change your beneficiary at any time.

Domestic Partnerships & Divorce

To establish a domestic partnership with LACERS, you must file a Declaration of Domestic Partnership or register your domestic partnership with the State of California. The Declaration of Domestic Partnership or State-registered domestic partnership must be filed at least 12 months prior to retirement in order for your domestic partner to be eligible for a Continuance benefit.

Filing a Declaration of Domestic Partnership with Personnel Department, Employee Benefits section is not sufficient to cover the administration of benefits with LACERS.

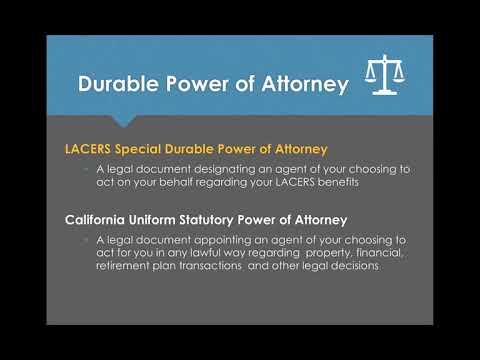

Durable Power of Attorney

Signing a Durable Power of Attorney may allow someone you select to take care of your financial affairs, including retirement benefits and health insurance benefits, in the event that you become incapable of managing your own affairs, either before or after you retire. Otherwise, it may be necessary to have the court appoint a conservator of your estate, which may be costly.